April 11, 2025: As Larry Fink Stated, "This Is Something WE'VE Created."

It’s a lesson most of us should have learned at the playground as kids… people will only take so much bullying before they simply decide they don’t want to play with you anymore.

I'm not messing around today: one screen is split between Reuters and New York Times live updates, one screen is on the BBC, and I'm scrolling Substack as well.

As I slept (very poorly, which is unfortunate), China announced a 125% tariff in retaliation for our 145% tariff. Yay. We're finally going to get a ruling on Mahmoud Khalil, and my fingers are crossed… there's also further turmoil expected in the markets.

NYT: A Trump envoy arrives in Russia for talks on Ukraine

Dmitri S. Peskov, Kremlin spokesman, says Steve Witkoff had flown to Russia but would not confirm if he’s set to meet with Putin.

I can’t help but notice that the war did not end on Day 1 of Trump’s presidency, and we seem no closer here on Day 82.

Reuters: US consumer sentiment deteriorates

Joanne Hsu, Surveys of Consumers Director: “This decline was pervasive and unanimous across age, income, education, geographic region and political affiliation… Consumers report multiple warning signs that raise the risk of recession: expectations for business conditions, personal finances, incomes, inflation, and labor markets all continued to deteriorate this month.”

Reuters notes that the consumer sentiment index dropped to 50.8, which is an even bigger drop than economists polled by Reuters predicted for the month.

WOWWWWWWW here it is folks, the biggie…

Reuters: BlackRock’s Larry Fink says the US is close to, if not in, a recession

Larry Fink: “This is not a pandemic, this is not a financial crisis, this is something that we’ve created.”

THAT’S THE TITLE OF THE POST RIGHT THERE: This is something that we’ve created.

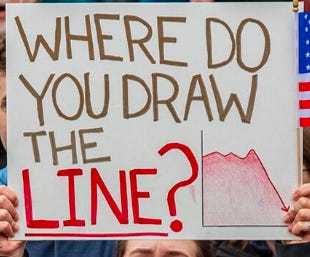

If we don’t confront and reckon with that reality, I fear that we’re in grave danger of missing the lessons to be found here; We The People, the stewards and producers of the largest economy in the world, elected a President who disdains the very institutions that made us the largest economy in the first place. We always have to add the caveat that propaganda and disinformation have never been more pervasive; that said, this reality points to a larger conversation our country will need to have in the coming years… how did our society get to a point where we were willing to elect someone so anti-American to lead America?

Navarro: “This team is just the best in history. America should trust in Trump. The market should trust in Trump and not get these weak knees, because this is going to be bullish. If you don’t sell, you don’t lose.”

It's exactly this kind of glib, dismissive commentary that makes the situation that much worse. Sure, yes, if you have years to spare, you could recover what you lost… but not everybody has years to spare.

My best friend in the entire world is named Sushi. He's been my roommate for 6 years or so, and he’s getting ready to purchase a house this year with his girlfriend. He's one of the people with “weak knees”, as Navarro puts it, because he had no choice but to pull out when tens of thousands of dollars started evaporating from his portfolio. He couldn’t just shrug it off and hope for the best.

Calling people like him “weak” for wanting to protect what they’ve earned is tone-deaf at best and downright callous at worst. It’s easy to tout patience when you're an insider who’ll be just fine either way, but everyday Americans facing real bills and real obligations have more on the line than some political talking point.

Meanwhile, as Peter Navarro and the Trump administration seem determined to shrug off investors’ real concerns about their policies, major executives on Wall Street are saying something else entirely:

Politico: Wall Street executives warn of economic turbulence as consumers brace for inflation

Larry Fink of BlackRock, Jamie Dimon of JP Morgan Chase, Charlie Scharf of

Wells Fargo… all pointing in their earnings call to a slower economy in 2025.

Stranger still is the rise of yields for US government bonds; historically, when the stock market starts to look volatile, investors would move their money to the bond market since it’s believed to be one of the safest in the world, but this has not been the case during the turmoil from tariffs. “The yield on a 10-year Treasury, which underpins corporate and consumer borrowing and is arguably the most important interest rate in the world, rose 0.1 percentage points on Friday,” wrote Joe Rennison and Colby Smith of the New York Times, adding that “These increases may seem small, but they are large moves in the Treasury market, prompting investors to warn that Mr. Trump’s tariff policies are causing serious turmoil.”

Simply put, there are signs that the world is losing faith in the U.S. economy.

Can’t say I blame them. Frankly, I’ve lost faith in us as well. I don’t mean to wax poetic about that which I can’t guarantee will happen, because I’m just a regular Joette in America with no great expertise… but I do think Americans today are living through a once-in-a-lifetime transition of global dominance that will NOT see us on top, in the end.

Reality is reality , problem being that we’ve been here , at least once before , Nixon and Carter era stagflation , and before that , the Great Depression , Harding caused that , understanding that is the first step , https://thistleandmoss.com/p/dumpster-fire-vs-historical-trash

https://thistleandmoss.com/p/premium-what-history-books-wont-tell